5 Tips To Build a Fashionable Share Portfolio

Building a share portfolio is like building a capsule wardrobe. According to Susie Faux, the owner of a London boutique called “Wardrobe” a capsule wardrobe is a collection of a few essential items of clothing that don’t go out of fashion, such as skirts, trousers, and coats, which can then be augmented with seasonal pieces.

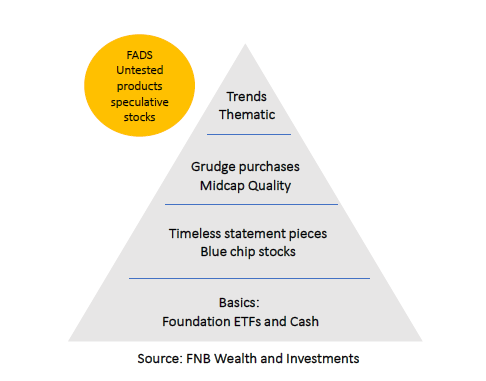

Just like a capsule wardrobe, your share portfolio should contain a few statement pieces that can define your overall investment strategy. “Simply defined a share portfolio is a person’s shareholdings/shares in one or two different companies. Your portfolio needs to be clean, versatile and contain the staple investments like the basics (TFSA, Cash), timeless statement pieces (Blue Chip stocks), grudge purchases (Midcap quality), and new long-term trends,” says Chantal Marx, Head of Research, FNB Wealth and Investments.

She adds that “capsule wardrobe fashion principles can serve as a foundation to building your share portfolio quite simply.” She outlines the following steps to building a great share portfolio:

- The biggest investment in your share portfolio will be the basics – Exchange Traded Funds like a Top 40 ETF, GOVI ETF, and SAPY ETF. Exchange traded funds are a low-cost option to own the entire market.

- Look at your timeless pieces like Blue Chip Stocks. These are large companies with a proven track record. The most important consideration here is to invest in ‘what you know’ and stay away where you don’t understand the company or don’t like it. For example – if you don’t like shopping at a specific clothing retailer, you should not invest in it!

- Grudge purchases like the midcap quality space. Ongoing research is very important and the principals of choosing Blue Chip stocks remains.

- A small part of your portfolio can consist of mega trends or thematic investments – something for the future. For example, if you find that you no longer make travel arrangements through an agent. Consider digital agencies like Booking.com. If you think streaming is the future – why not consider an investment in Netflix.

- And then you have the FAD. Beware of the FAD. The easiest way to spot a FAD investment or scam is by asking yourself. Do I understand what it is? How does the underlying company make money? Am I being pushed into an investment? Must I recruit people to get my returns? If you don’t understand it and have no clear direction on the answers – stay as far away as possible

“Just like pulling a classic capsule wardrobe together, ensure that your share portfolio defines your investment and personal money objectives. Rather invest in what you know, instead of the unknown – this will make or break your investment goals,” concludes Marx.