SA Fintech Launches Affordable Pre Paid Insurance

A shocking 70% of South Africans don’t have car insurance. That’s 12 million cars on the roads whose owners simply can’t afford insurance. A black-owned South African insurtech has come up with the answer – car accident cover on demand. Just like airtime, you buy the cover you can afford only when you need it and you recharge when you need to.

“Insurance companies actually penalise you if you live in a poorer area and drive a cheaper car – they charge less to insure fancy cars in fancy areas. It just makes no sense to me that those South Africans who need better prices are quoted more! Plus most of us are hardly driving our cars during Covid-19. Vaai.co developed the answer for those who can’t afford ongoing car insurance and those that have had enough of the great car insurance rip-off,” explains the co-founder of Vaai.co, Thabang Butelezi.

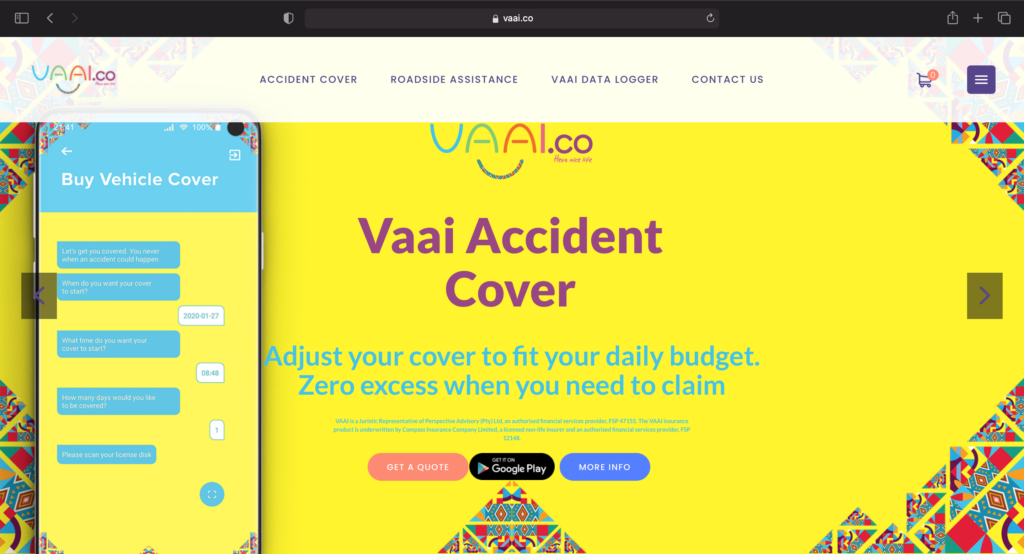

“Instead of paying for car insurance monthly via debit order for the rest of your life, you simply download the free Vaai.co app from the Google Play store and buy the prepaid insurance for 24 hours. You are totally in control and can adjust cover to suit your budget, because having some cover is better than nothing. For instance, for less than the price of two 2 litre cold drinks you get R13 000 cover. If you have more money available, you can buy up to R120 000 worth of cover.”

Butelezi cautions consumers that Vaai.co is not a replacement for traditional car insurance. It offers affordable basic cover per day when you need it but the cover is only for accidents. “Vaai.co is for those times you think a specific driving occasion is riskier.”

Another drawback of traditional car insurance is that once you are involved in an accident, you generally pay an excess. Many are shocked when that happens and have to take personal loans to cover the excess amount, which can run into the ten thousands. For this reason, Vaai.co offers insurance with zero excess from the very first day without any debit orders.

“And we also don’t care about your claims history. We keep things very simple – you select the amount of cover you need for the next 24 hours based on what you can afford,” says Duncan Barker, co-founder of Vaai.co. Payment is made on the app or cash payments are accepted at FNB ATMs.

To buy your insurance, you will need to purchase a once-off data logger for R350 which is delivered to you or you can get it via an agent. The data logger runs diagnostics on your car, saving you money on expensive mechanical and electrical damage. It also allows Vaai.co to detect if you have a major accident and can dispatch a towing service and support to you.

In addition, South African road users can use the Vaai app to get on-demand roadside assistance.

Vaai.co took part in the AlphaCode Incubate programme, a prestigious R10 million fintech startup support initiative. “Vaai.co is right on trend with its insurance on demand concept. We believe that there’s a tremendous need for innovation in the insurance space, particularly during Covid-19 when finances are stretched to the max and existing models are no longer affordable. Vaai.co has developed a compelling solution for South Africans with cars who want cover, but can’t afford traditional insurance,” says Dominique Collett, a senior investment executive at Rand Merchant Investments and the head of AlphaCode.

Vaai.co is underwritten by Compass Insurance and is currently only available in Gauteng with plans to expand nationally. You can go to www.vaai.co, download the app from the Google Play store or call 010 100 8224.