Stitch Launches CashPay To Enable Consumers To Access Digital Products And Services Via Cash Payments

Stitch Launches CashPay To Enable Consumers To Access Digital Products And Services Via Cash Payments. South African fintech StartUp Stitch has announced the launch of CashPay which aims to give consumers more choice in how they wish to pay and to expand the opportunity for businesses to accept cash payments. The company took to LinkedIn to make the announcement.

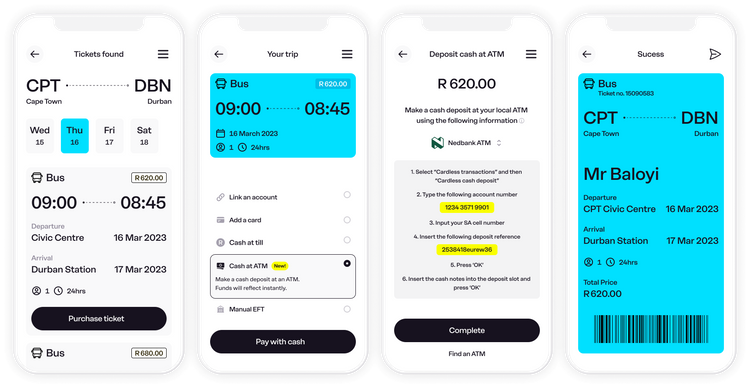

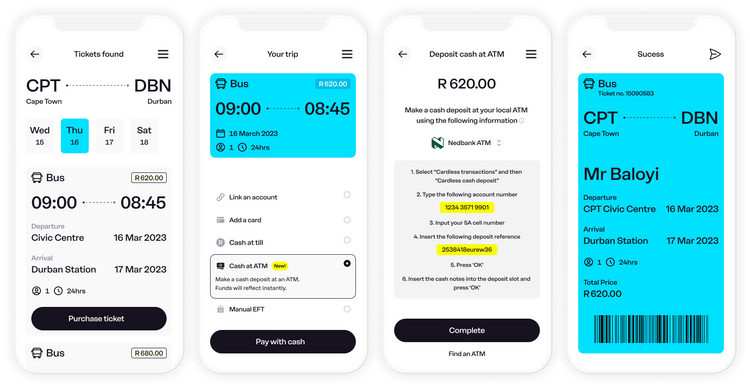

The post read, “More than 50% of South Africans prefer to make transactions in cash. As a result, businesses are facing a missed opportunity to reach a vast cohort of consumers with digital products and services. Enter Stitch CashPay. 💰Today, we’re excited to announce the launch of a new product that will give consumers more choice in how they wish to pay and to expand the opportunity for businesses to accept cash payments, better reaching consumers currently excluded from the financial system. With CashPay, virtually any business that accepts digital payments can:🏧 Accept cash deposits made at ATMs and retailers across South Africa;📲 Receive instant notifications for any transaction completed; Automatically attribute payments to the customer’s account and🪡 Reconcile cash payments seamlessly alongside other Stitch methods.”

Current Stitch clients can add CashPay to their integration with minimal development work. New Stitch clients can access CashPay alongside other methods such as Instant EFT, Direct Deposit and Payouts through a single integration. Stitch’s payments solutions help businesses seamlessly connect to the financial system, so they can operate more efficiently and grow more quickly. The company seeks to build developer-friendly infrastructure, APIs and tools that simplify and optimise the task of creating delightful financial experiences.

Stitch President Junaid Dadan said in a statement, “We created CashPay to give consumers more choice in how they wish to pay, enabling them to access digital products and services via cash payments, at ATMs or retailers across South Africa. With CashPay, tasks like making a deposit into a wallet-based app, or purchasing transport tickets, can be carried out at the same time as a grocery purchase and paid in cash at the same till. Funds paid are instantly allocated to a customer’s digital account, and businesses enjoy seamless reconciliation on the backend.”