Stitch Announces That It Is Now An End-To-End Payments Service Provider

Stitch Announces That It Is Now An End-To-End Payments Service Provider. Stitch President Junaid Dadan has announced that Stitch is evolving into a full Payments Service Provider – defined as a third party that enables businesses to accept, manage and send digital payments through a variety of methods.

Stitch is a client-first business. The company works closely with client teams as more than a payments provider; it acts as a thought partner, helping them to optimise the way they run their payments environments. Over time, its clients have started asking to support them with even more solutions. This evolution is in large part a response to that demand, and an effort to fill gaps the company still sees in the market across the payments stack. Today, the Stitch payments suite is designed specifically for businesses with complex payments needs, offering a high level of flexibility and customisation.

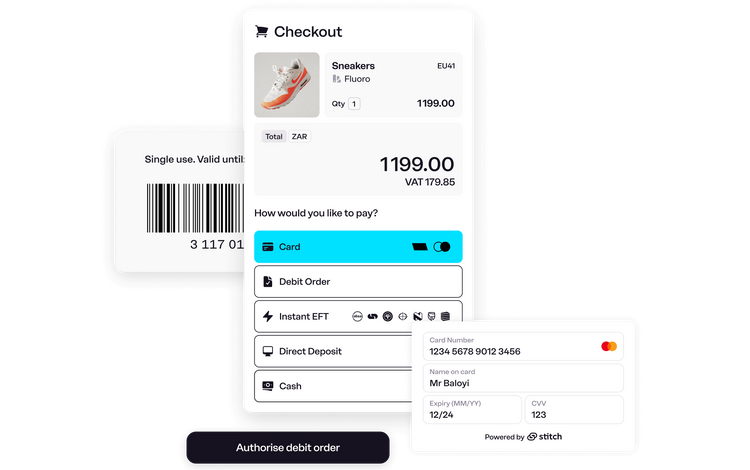

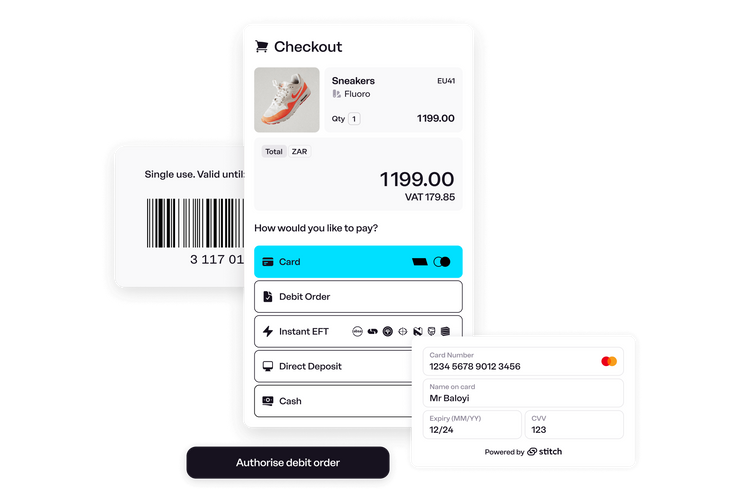

Through a single API integration, now Stitch clients can: accept payments across methods including Instant EFT, Debit + Credit Card, Direct Deposit, Debit Order and Cash; track, manage and reconcile payments received across multiple methods, providers and geographies with PayOS; and easily disburse funds with Payouts. Thanks to these direct integrations, the company can aggregate and standardise data from across providers into a single source of truth, simplifying the reconciliation process and making finance and payments teams much more efficient.

Clients that use multiple PSPs for pay-ins struggle with reconciliation across banks and providers, as well as with the large engineering lift required to enable and maintain these integrations. PayOS is a SaaS solution – the first of its kind in the market – that enables clients to integrate directly into multiple PSPs and manage payments across methods, providers and geographies, all through a single integration. PayOS offers more freedom when it comes to the way clients manage and orchestrate their payments because it allows them the flexibility to maintain existing commercial agreements, and set their own rules based on which methods and providers work best for particular customers in particular instances.

Clients can easily send refunds and withdrawals, and disburse funds via Payouts, in real-time over API. Stitch helps clients manage float and ensure payouts are settled into verified recipient accounts. For existing Stitch clients, additional development work required to enable these new solutions is minimal. For new Stitch customers, all payment methods can easily be combined via a single integration, and managed via PayOS.