Auto & General: A Journey of Innovation and Resilience in the Insurance Industry

Auto & General: A Journey of Innovation and Resilience in the Insurance Industry. In the dynamic landscape of South Africa’s insurance sector, Auto & General has emerged as a beacon of innovation and customer-centric service. Founded in June 1985 as part of Telesure Investment Holdings (TIH), the company embarked on a mission to redefine insurance services for South Africans. Over the decades, Auto & General has navigated challenges, embraced technological advancements, and expanded its offerings, solidifying its position as a leader in the industry.

Foundation and Early Vision

The mid-1980s presented a burgeoning demand for insurance products tailored to the unique needs of South African consumers. Recognizing this, Auto & General was established with a commitment to service excellence and a vision to offer comprehensive insurance solutions. This dedication quickly set the company apart, laying the groundwork for its future success.

Lesson for Entrepreneurs: Identifying and addressing specific market needs with a clear vision can establish a strong foundation for long-term growth.

Strategic Diversification and Growth

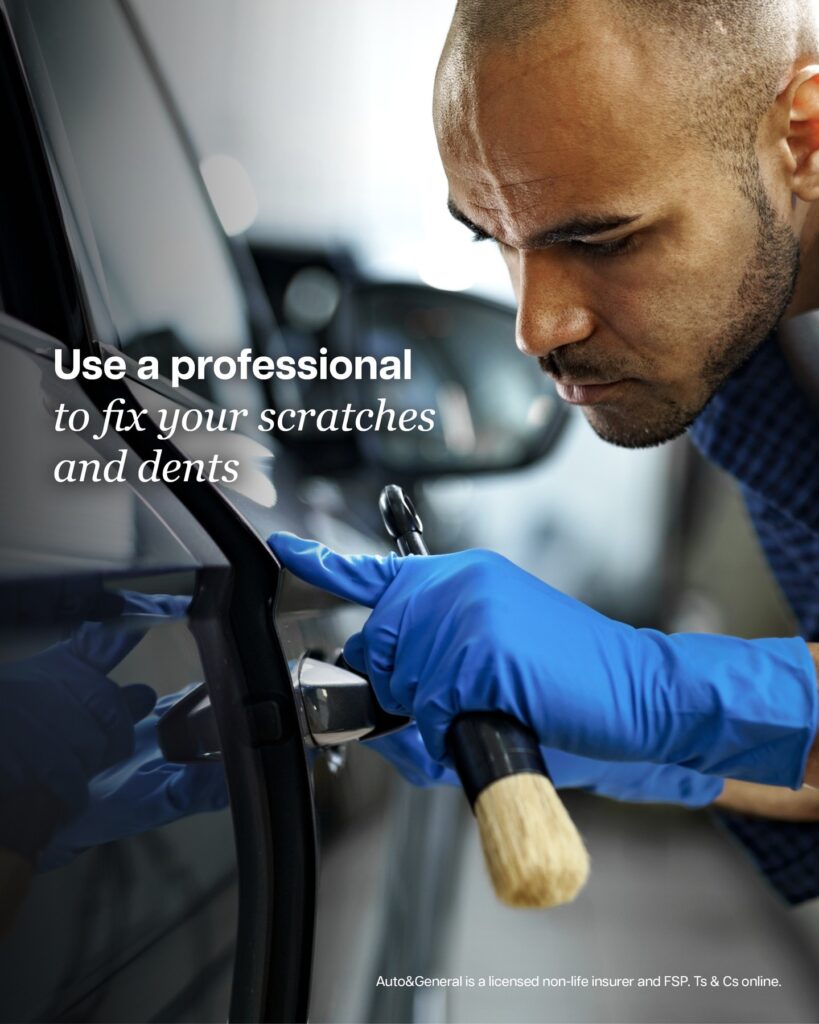

As the company matured, it strategically diversified its product portfolio to include car, home, business, and life insurance, along with value-added products. This expansion not only catered to the evolving demands of customers but also showcased Auto & General’s agility in a competitive market.

Lesson for Entrepreneurs: Diversifying offerings in response to customer needs can enhance market presence and resilience.

Embracing Technological Innovation

In an era where digital transformation became imperative, Auto & General introduced “MyPolicy,” an online platform empowering policyholders to manage their insurance portfolios at their convenience. This initiative not only improved customer experience but also positioned the company as a forward-thinking industry player.

Lesson for Entrepreneurs: Leveraging technology to enhance customer interaction can lead to increased satisfaction and operational efficiency.

Commitment to Community and Corporate Social Responsibility

Beyond business operations, Auto & General demonstrated a profound commitment to social responsibility. Following the devastating fires in the Southern Cape, the company swiftly settled all claims, including 20% more in a week than in all of 2016, and provided 24-hour personal assistance and free trauma counseling to affected customers. Additionally, partnerships with organizations like the Diepsloot Foundation and initiatives such as the Diepsloot Food Security Programme underscore their dedication to community upliftment.

Lesson for Entrepreneurs: Engaging in meaningful corporate social responsibility initiatives can strengthen community relations and enhance brand reputation.

Building Robust Partnerships

Recognizing the value of collaboration, Auto & General cultivated strong relationships with brokers and various South African businesses. The introduction of Business Insurance in 2005 further bolstered broker engagement, contributing significantly to the company’s growth and customer trust.

Lesson for Entrepreneurs: Fostering strategic partnerships can amplify reach and credibility in the market.

Accolades and Industry Recognition

The company’s unwavering dedication to excellence has been acknowledged through numerous awards, including:

- Winner in the short-term insurance category at the Ask Afrika Orange Index Awards (2022/2023).

- Voted best personal and business insurance in the annual Best of Joburg Readers Choice Awards (2022).

- Recognized for having the lowest number of complaints and the best Overturn Rate in South Africa.

Lesson for Entrepreneurs: Consistent quality and customer focus can lead to industry recognition, enhancing brand credibility.

Navigating Challenges and Demonstrating Resilience

The insurance industry is fraught with challenges, from economic fluctuations to natural disasters. Auto & General’s proactive approach in settling claims and supporting customers during crises exemplifies resilience and a customer-first mindset.

Lesson for Entrepreneurs: Prioritizing customer needs during challenging times fosters loyalty and trust.

Conclusion

Auto & General’s journey from a burgeoning insurer to an industry leader is a testament to strategic vision, adaptability, and an unwavering commitment to service excellence. For aspiring entrepreneurs, the company’s story offers valuable insights into building a resilient and reputable brand in a competitive landscape.

Final Thought: Success is not solely measured by financial growth but by the positive impact on customers and the broader community.