How EasyEquities Revolutionized Investing in South Africa: Key Strategies Behind Its Market Success

How EasyEquities Revolutionized Investing in South Africa: Key Strategies Behind Its Market Success. In a country where stock market investing was once reserved for a privileged few, EasyEquities disrupted the status quo and made investing accessible to the everyday South African. From its humble beginnings to becoming one of the most recognized investment platforms in the country, EasyEquities’ rise is a case study in authenticity, resilience, and strategic innovation.

Breaking Barriers: The Birth of EasyEquities

Launched in 2014 by Purple Group, EasyEquities entered the market with a clear mission: to democratize investing. At a time when traditional brokers imposed high fees and minimum investment thresholds, EasyEquities introduced a platform that allowed users to invest with as little as R5. This low-cost, fractional-share model immediately set them apart.

By focusing on affordability and simplicity, EasyEquities tapped into a large, underserved market—ordinary South Africans who had previously been excluded from equity ownership due to cost and complexity.

Authenticity at the Core

One of EasyEquities’ key differentiators has been its authentic approach to customer engagement. Instead of positioning itself as an exclusive financial service, the brand built its identity around community and education. Through webinars, blogs, and social media content, the platform prioritized investor literacy, helping users understand the mechanics of investing without overwhelming them with jargon.

This authenticity fostered trust. EasyEquities wasn’t just offering a service; it was empowering people to take control of their financial futures.

Lesson for entrepreneurs: Build a brand around genuine value and connection. Educating your audience and making them feel part of your journey can be more powerful than any traditional advertising campaign.

Strategic Marketing That Worked

EasyEquities’ marketing strategy focused on digital-first outreach. By leveraging social media platforms, influencer partnerships, and user-generated content, the brand created a viral presence without relying on traditional advertising budgets.

Campaigns were designed to be relatable and shareable. For example, collaborations with well-known South African personalities helped bridge the gap between finance and culture, turning investing into a mainstream conversation.

Lesson for entrepreneurs: Understand where your audience spends their time and meet them there. Storytelling and relatable content can transform complex products into movements.

Key Milestones in the Journey

- 2014 – EasyEquities launched, introducing fractional investing to the South African market.

- 2015-2016 – Rapid user growth, driven by word-of-mouth and social media.

- 2017 – Won awards for innovation, cementing its reputation as a disruptor.

- 2020 – Benefited from the COVID-19 lockdown boom, with increased interest in online investing as people sought alternative income streams.

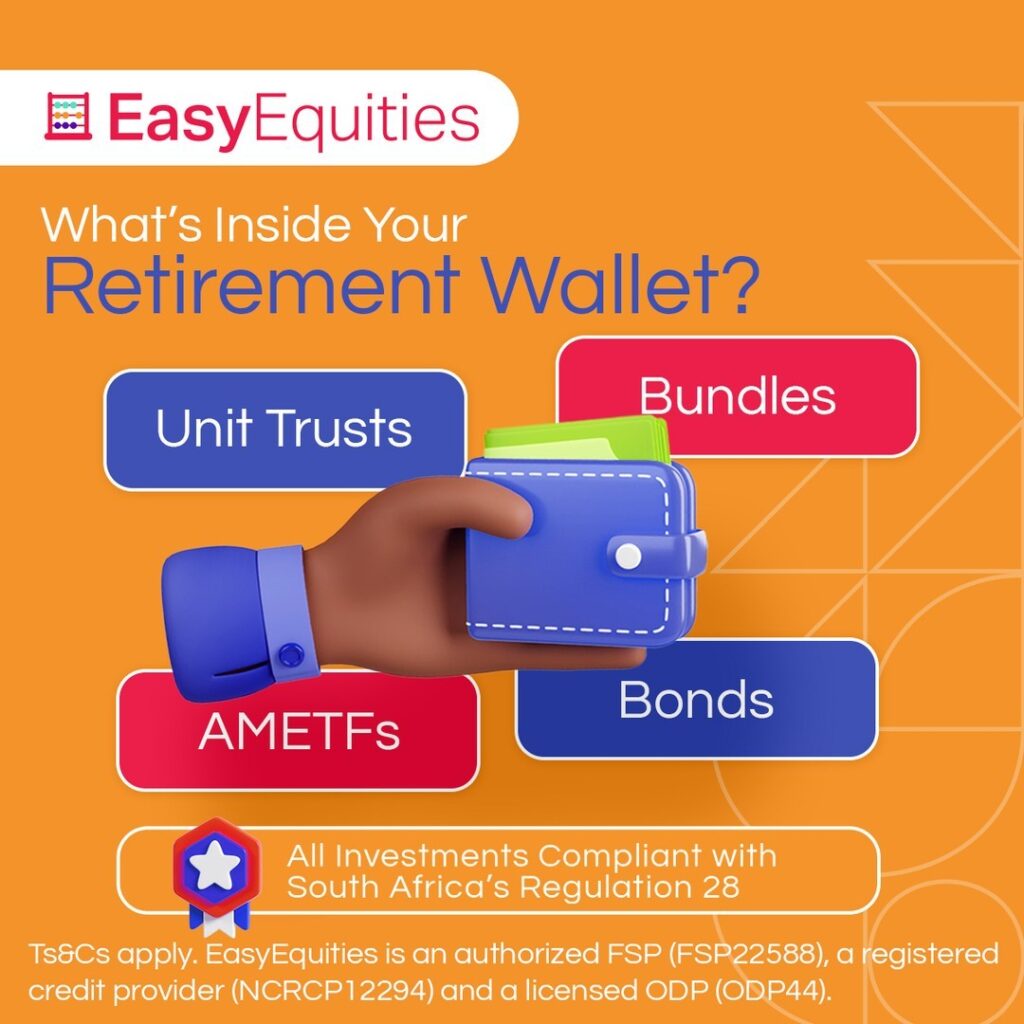

- 2021-2022 – Expanded its product offering to include retirement annuities and tax-free savings accounts, providing a more holistic financial service.

- 2023 – Formed partnerships with brands like Capitec to integrate investment offerings into banking apps, dramatically increasing its customer reach.

Overcoming Challenges

Despite its growth, EasyEquities faced hurdles. Skepticism from traditional investors, regulatory compliance, and the need to continually scale its technology infrastructure were ongoing challenges.

However, its resilience came from maintaining a clear focus on its core purpose—making investing easy and affordable—and adapting its platform as demand grew. Regular feedback loops with users allowed the team to refine the platform and maintain a strong user experience, even during high-traffic periods.

Lesson for entrepreneurs: Growth often exposes weaknesses. Listening to your users and adapting quickly is essential to sustainable success.

Innovative Expansion Efforts

EasyEquities didn’t settle after its initial success. The platform expanded its asset classes, allowing users to invest not only in local stocks but also in U.S. equities, ETFs, and cryptocurrencies. The addition of educational resources, demo accounts, and goal-setting tools enhanced user engagement and retention.

Strategic partnerships, like its integration with Capitec Bank, gave EasyEquities access to millions of new potential investors directly within a trusted banking environment. This move demonstrated the power of collaboration over competition in driving growth.

Lesson for entrepreneurs: Look for symbiotic partnerships. Aligning with complementary brands can unlock new markets and scale your impact.

What Aspiring Entrepreneurs Can Learn

The EasyEquities story proves that success isn’t about reinventing the wheel—it’s about making something complicated feel simple and inclusive. Their journey shows the importance of:

- Solving real problems.

- Staying authentic to your mission.

- Leveraging digital tools for community building.

- Continuously innovating and expanding thoughtfully.

- Building strategic partnerships for growth.

Conclusion

EasyEquities didn’t just build a product; they built a movement that changed how South Africans think about investing. By staying true to their mission, embracing digital engagement, and forming meaningful collaborations, they have set a blueprint for modern entrepreneurial success.

For anyone looking to disrupt an industry or grow a brand, EasyEquities is a reminder that with authenticity, strategy, and resilience, you can turn big ideas into lasting impact.