The Bitcoin Blueprint: How a Decentralized Idea Disrupted Global Finance

The Bitcoin Blueprint: How a Decentralized Idea Disrupted Global Finance. When Bitcoin quietly emerged in 2008, it wasn’t introduced by a global corporation or promoted through an elaborate marketing campaign. Instead, it appeared as a nine-page whitepaper shared on a cryptography mailing list, authored by an individual—or group—under the pseudonym Satoshi Nakamoto. What began as an experiment in decentralized digital currency has since become one of the most disruptive forces in modern finance, challenging the very foundations of traditional banking and reshaping how people think about money.

Bitcoin’s rise is more than the story of a technology—it’s a blueprint for how resilience, authenticity, and innovative thinking can drive global change. For entrepreneurs, its journey provides real-world lessons on navigating uncharted territory, building communities, and pushing forward through doubt and resistance.

The Genesis of Bitcoin: A Solution to a Broken System

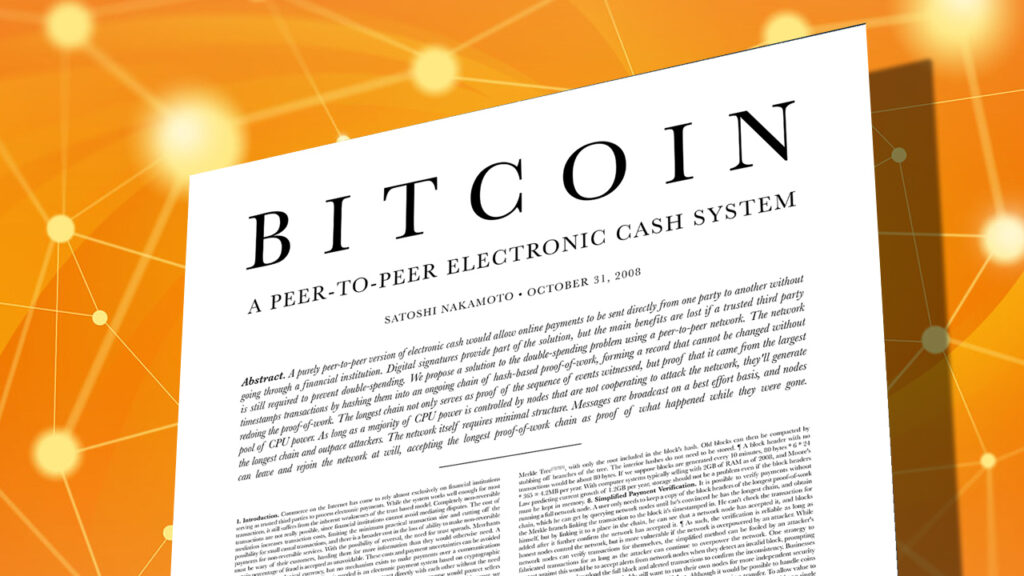

Bitcoin was born out of the financial crisis of 2008—a time when trust in banks and centralized financial systems was at a historic low. In October of that year, Nakamoto published the “Bitcoin: A Peer-to-Peer Electronic Cash System” whitepaper, proposing a way for people to send digital payments directly to each other without relying on banks, governments, or intermediaries.

In January 2009, Nakamoto mined the first-ever Bitcoin block, known as the Genesis Block, embedding a message that read:

“The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.”

This wasn’t just code. It was a statement—a reminder of why Bitcoin existed: to create an alternative financial system based on transparency, security, and decentralization.

Lesson for Entrepreneurs:

Find a real problem to solve. Bitcoin’s purpose was rooted in addressing a global issue, which gave it authenticity and staying power.

Building Trust Without a Face: The Power of Open-Source Community

One of Bitcoin’s most remarkable feats is that it grew without a traditional company, CEO, or marketing budget. Nakamoto released Bitcoin as open-source software, inviting anyone to inspect, improve, and use the code. Early adopters—many from the cryptography and tech communities—began mining, transacting, and building on Bitcoin, turning a concept into a living network.

The Bitcoin community, not a central organization, drove its growth. Forums, chat rooms, and conferences became the heartbeat of Bitcoin’s expansion. Word spread through grassroots advocacy, online discussions, and the commitment of people who believed in its mission.

Actionable Insight:

A strong, engaged community can be one of the most powerful growth drivers. Empower users to take ownership and be ambassadors of your vision.

Challenges and Resilience: Navigating Volatility and Criticism

From its earliest days, Bitcoin faced significant skepticism. Critics called it a scam, a bubble, or a tool for illicit activity. Price volatility brought extreme highs and painful crashes. Regulatory uncertainty added further obstacles, as governments around the world struggled to define and manage a currency that wasn’t issued by any nation.

Yet, through every downturn, Bitcoin’s core principles held steady: decentralization, scarcity (with a capped supply of 21 million BTC), and security through its blockchain technology. Its resilience wasn’t just about price recovery—it was about maintaining its original purpose despite external pressures.

Lesson for Entrepreneurs:

Criticism and setbacks are inevitable, especially when challenging the status quo. Staying focused on your core mission is essential for long-term endurance.

Scaling Beyond Borders: Global Adoption and Institutional Entry

In the 2010s, Bitcoin transitioned from a niche internet curiosity to a legitimate financial asset. Exchanges like Coinbase, Binance, and Kraken made buying and selling Bitcoin accessible to everyday users. Payment platforms such as PayPal and Square integrated Bitcoin into their services, making it easier to transact.

Perhaps most notably, El Salvador’s 2021 decision to adopt Bitcoin as legal tender marked a historic moment. For the first time, a nation-state recognized Bitcoin as an official currency, signaling a new phase of adoption.

Institutional investors, including major funds and corporations, also began allocating capital to Bitcoin, viewing it as a hedge against inflation and a store of value.

Actionable Insight:

Innovative ideas often start on the fringes but can scale globally with strategic partnerships and infrastructure that lower barriers to entry.

Innovative Features that Fueled Growth

- Decentralization: No central authority controls Bitcoin, making it resistant to censorship and single points of failure.

- Blockchain Security: Every transaction is recorded on a public ledger, ensuring transparency and trust.

- Scarcity: With a fixed supply of 21 million coins, Bitcoin introduced digital scarcity, which contributes to its value proposition.

- Halving Events: Every four years, Bitcoin’s mining rewards are cut in half, reducing supply growth and often impacting price dynamics.

What Entrepreneurs Can Learn from Bitcoin’s Rise

The story of Bitcoin isn’t just about cryptocurrency; it’s about the power of ideas, the importance of solving real-world problems, and the resilience required to disrupt entrenched systems.

Key lessons include:

- Purpose matters. Bitcoin addressed a global problem of trust in centralized finance.

- Community builds momentum. An engaged, passionate user base can drive a brand’s success without traditional marketing.

- Resilience is critical. Navigating criticism, regulation, and volatility requires focus and commitment.

- Scale comes through accessibility. Making products easier for people to use accelerates adoption.

- Innovation can redefine industries. Bitcoin didn’t just improve the financial system—it proposed an entirely new one.

Bitcoin’s journey from an obscure whitepaper to a multi-trillion-dollar asset class shows what’s possible when vision, strategy, and authenticity come together. For entrepreneurs everywhere, it’s proof that even the most disruptive ideas can change the world—if you’re prepared to stand by them through every challenge.