Kazang’s Journey: Empowering Informal Traders

Kazang’s Journey: Empowering Informal Traders. In the heart of Southern Africa’s bustling informal markets, Kazang has emerged as a transformative force, revolutionizing the way micro-merchants conduct business. By providing accessible financial services and embracing digital solutions, Kazang has not only empowered small traders but also contributed significantly to financial inclusion in the region.

Bridging the Financial Divide

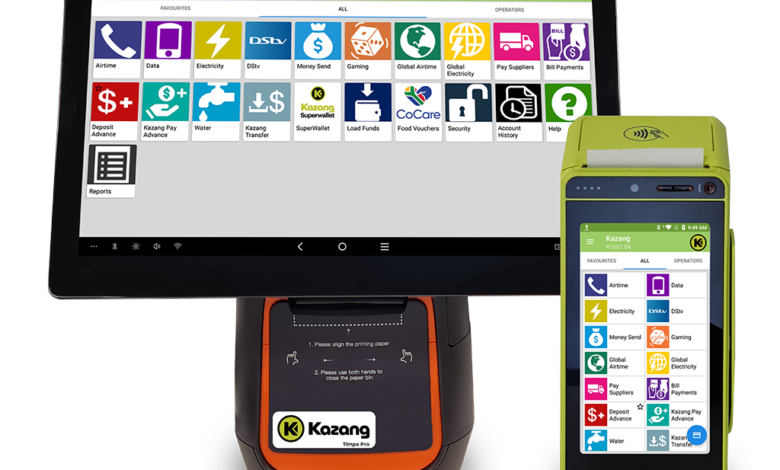

Kazang’s mission centers on enabling micro-merchants to offer a suite of value-added services (VAS) such as prepaid electricity, airtime, data, DSTV subscriptions, bill payments, and gaming vouchers. With a network of approximately 90,000 VAS terminals processing around 3 million transactions daily, Kazang has become an integral part of the informal economy, offering convenience to consumers and new revenue streams for merchants.

Embracing Card Payments

Recognizing the shift towards digital transactions, Kazang introduced Kazang Pay, a card acceptance solution that allows merchants to accept VISA debit and credit cards, as well as mobile wallet payments. This initiative has seen over 50,000 VAS terminals enabled for card payments, facilitating a transition from cash to digital transactions and enhancing security and efficiency for merchants.

Strategic Partnerships and Expansion

Kazang’s growth strategy includes strategic partnerships and acquisitions to expand its service offerings and geographic reach. Notably, the acquisition of a 49% stake in Sandulela Technology, a prepaid electricity wholesaler, allowed Kazang to extend its services into rural and peri-urban areas, providing easy access to electricity for underserved communities.

Internationally, Kazang has expanded into Zambia, introducing Kazang Pay to enable card payments for merchants. With around 12,000 VAS terminals already in operation in Zambia, Kazang aims to enable the majority of them to accept card payments, further promoting financial inclusion in the region.

Innovative Rewards Platform

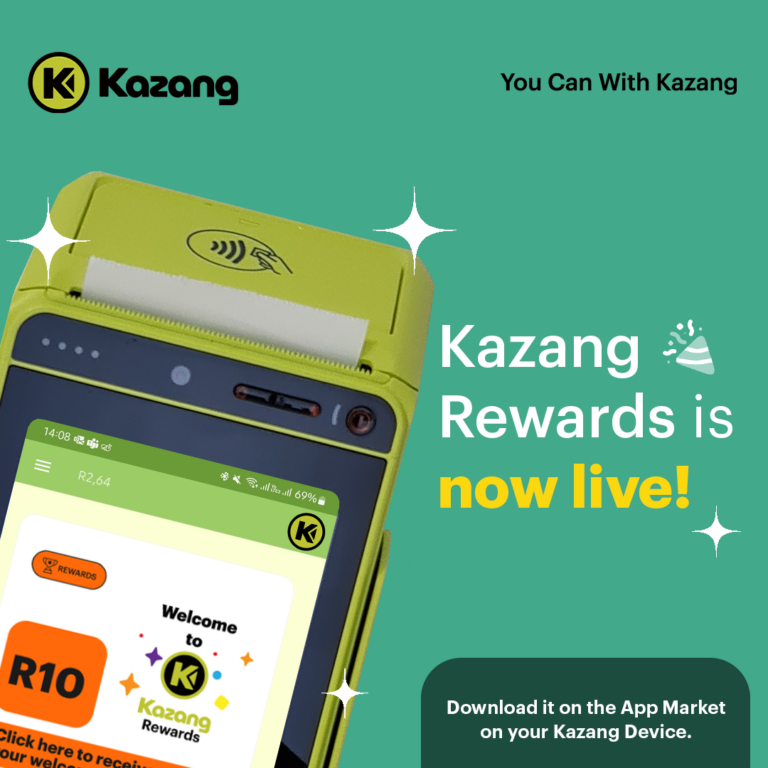

To incentivize and support merchants, Kazang launched the Kazang Rewards platform, a multi-faceted system that allows merchants to earn rewards for completing tasks such as achieving sales targets and participating in surveys. This platform not only boosts merchant engagement but also provides valuable insights into customer behavior for partner brands.

Commitment to Community Development

Kazang’s impact extends beyond financial services; the company is committed to community development and youth empowerment. Through a partnership with Masifunde Training and Development, Kazang provides employment opportunities and practical experience to disadvantaged youth, contributing to skills development and job creation in South Africa.

Lessons for Entrepreneurs

Kazang’s journey offers valuable insights for aspiring entrepreneurs:

- Identify and Address Market Needs: Kazang recognized the lack of financial services in informal markets and developed solutions tailored to this segment.

- Leverage Technology for Inclusion: By embracing digital payment solutions, Kazang facilitated financial inclusion for both merchants and consumers.

- Strategic Partnerships Drive Growth: Collaborations and acquisitions enabled Kazang to expand its services and reach new markets effectively.

- Invest in Community Development: Kazang’s commitment to empowering youth and supporting communities has strengthened its brand and social impact.

- Innovate Continuously: The introduction of the Kazang Rewards platform demonstrates the importance of innovation in maintaining merchant engagement and satisfaction.

Kazang’s success story underscores the potential of combining technology, strategic partnerships, and community engagement to drive meaningful change in underserved markets. Entrepreneurs can draw inspiration from Kazang’s approach to creating inclusive, sustainable business models that address real-world challenges.