5 Financial Tips For South African Small Businesses

5 Financial Tips For South African Small Businesses. By diversifying funding, closely managing cash flow, taking advantage of tax incentives, investing in technology, and preparing for emergencies, small businesses in South Africa can navigate financial challenges and stay competitive. Here are 5 financial tips for South African small businesses to help improve their financial stability and growth:

Diversify Funding Sources: Relying on one source of funding, such as traditional bank loans, can be risky. Explore alternative funding options like venture capital, crowdfunding, angel investors, or government-backed initiatives like the Small Enterprise Finance Agency (SEFA). This can provide you with flexibility and improve cash flow management.

Maintain a Healthy Cash Flow: Cash flow is the lifeblood of any small business. Implement strict invoicing processes to ensure timely payments from customers. Consider offering discounts for early payments or using digital tools like fintech platforms to automate billing and payment tracking. Keep a close eye on expenses, ensuring you don’t overspend during slow periods.

Leverage Tax Benefits: South Africa offers several tax incentives for small businesses, such as the Small Business Corporation (SBC) tax regime. Ensure you’re making the most of tax deductions and credits available to you. Work with a tax professional to stay compliant while optimizing your tax strategy.

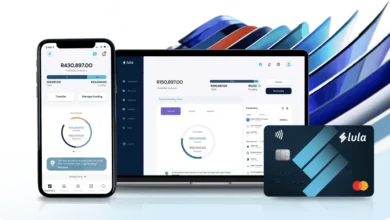

Invest in Technology: Digital tools like accounting software (e.g., Xero, QuickBooks) can help you manage your finances more efficiently, allowing you to track expenses, monitor cash flow, and generate reports in real-time. Using technology also enables better financial forecasting and planning.

Plan for Financial Emergencies: Have a solid financial buffer for emergencies. Set aside part of your profits into a reserve fund to cover unexpected expenses or downturns. This will ensure your business can stay afloat during tough times without needing to rely on high-interest loans or credit lines.