How Fintech Bridges Gaps For Township Merchants

How Fintech Bridges Gaps For Township Merchants. Merchants in South Africa’s cash-driven township and rural economy remain underserved by the mainstream financial services sector, creating opportunities for fintech companies to address their pain points. These innovative solutions empower merchants to better serve their customers and operate efficiently.

That’s according to Lincoln Mali, CEO of Lesaka Technologies, who spoke at the Township Economy Summit 2024, hosted by the Township Entrepreneurs Alliance (TEA). “South Africa’s merchant market remains underpenetrated, with huge addressable opportunities,” Mali said.

He noted that legacy financial service providers fail to meet specific needs, such as:

- Digital payment solutions.

- Access to growth capital.

- Secure and automated cash management tools tailored to informal merchants.

With over 500 townships across South Africa and an informal market estimated at R900 billion, the sector is experiencing strong growth. Factors such as:

- Competitive pricing offered by informal merchants.

- Improved customer experience at spazas and townships.

- Reduced transport costs for customers.

Mali emphasised the need for businesses to recognise the value of township entrepreneurs and form partnerships to offer innovative solutions that foster sustainable growth. “The township economy is a remarkable ecosystem of innovation, resilience, and entrepreneurial energy. Informal traders play a crucial role in sustaining countless livelihoods.”

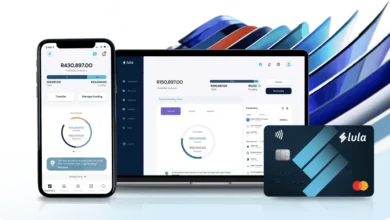

Lesaka Technologies, with R72 billion in throughput across 93,000 merchants, is building a holistic ecosystem for township merchants. Through its subsidiary, Kazang, Lesaka provides innovative solutions such as:

- Card payments acceptance to reduce reliance on cash.

- Lending options to help businesses grow.

- Value-added services (VAS) like airtime and bill payments.

- Safe, cashless supplier payments.

- Data insights to enable better pricing and promotional decisions.

The Kazang VAS terminal is a critical tool, offering merchants the ability to:

- Accept card payments.

- Process cashbacks.

- Vend prepaid services, such as electricity, airtime, data, and gaming vouchers.

“Our business isn’t just about providing a POS device. We bring the bank into the store, empowering merchants to innovate and grow,” said Mali. “The goal is to be a true partner to entrepreneurs, driving shared prosperity.”