The Rise of Liberty Group: How a South African Insurer Became an Industry Giant

The Rise of Liberty Group: How a South African Insurer Became an Industry Giant. Founded in 1957, Liberty Group has grown from a small life insurance company into one of South Africa’s leading financial services providers. Its journey is one of resilience, innovation, and strategic expansion, driven by a commitment to making financial security accessible to a broader population. Through bold leadership, market foresight, and key partnerships—such as its integration with Standard Bank—Liberty has continuously adapted to economic shifts and industry disruptions. This article explores the pivotal moments and strategies that shaped Liberty’s rise, offering valuable lessons for entrepreneurs looking to build sustainable and impactful businesses.

The Humble Beginnings: A Vision for Financial Security

In the late 1950s, South Africa’s insurance landscape was dominated by traditional firms that catered primarily to the wealthy. In 1957, Donald Gordon, a visionary entrepreneur, saw a gap in the market—ordinary South Africans lacked access to affordable and comprehensive life insurance. He founded Liberty Life, laying the foundation for what would become one of South Africa’s most influential financial services companies.

Gordon’s strategy was simple yet revolutionary: democratize financial security. He introduced life insurance policies tailored to middle-income earners, making protection and investment accessible to a broader population. This customer-first approach would remain central to Liberty’s growth strategy over the decades.

Navigating Challenges and Market Disruptions

Like any great enterprise, Liberty faced significant challenges. Economic downturns, regulatory changes, and shifts in consumer behavior tested the company’s resilience. During South Africa’s turbulent political climate in the 1980s and early 1990s, the financial sector faced uncertainty. Liberty, however, remained steadfast, adapting its investment strategies to ensure stability and long-term growth.

One key lesson from Liberty’s approach was its ability to balance innovation with risk management. When faced with economic uncertainty, the company diversified its portfolio, expanding into asset management and investment services. By doing so, it reduced dependency on life insurance alone, ensuring sustainable growth.

Expansion and Strategic Acquisitions

As Liberty’s brand strengthened, it pursued an aggressive expansion strategy. In the 2000s, it extended its footprint beyond South Africa, entering other African markets. The company recognized the growing demand for financial services across the continent and strategically positioned itself in countries like Kenya, Nigeria, and Namibia.

Additionally, strategic acquisitions played a crucial role in Liberty’s rise. The company acquired established firms to enhance its product offerings and market reach. One of the most pivotal moments came as Standard Bank gradually increased its stake in Liberty Holdings over time, eventually gaining full control. This partnership allowed Liberty to leverage Standard Bank’s customer base, offering integrated banking and insurance solutions—a move that significantly boosted its market share.

Innovation in Financial Services

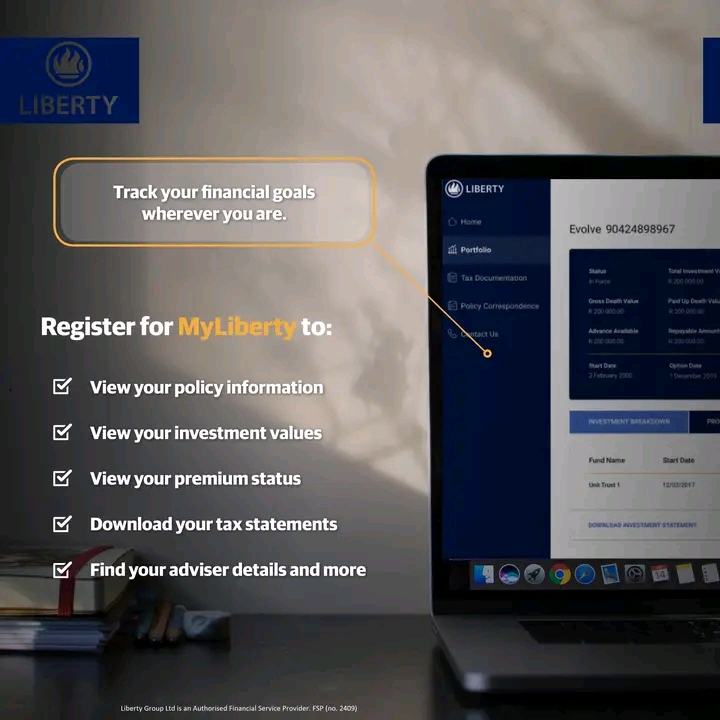

Liberty has continually embraced innovation to stay ahead of competitors. It was among the South African insurers that introduced unit-linked life insurance policies, giving policyholders more control over their investments. Additionally, the company’s digital transformation efforts have enhanced customer experience, from streamlined claims processes to AI-driven financial advisory tools.

Liberty has also engaged in various corporate social responsibility initiatives aimed at financial literacy. While specifics on large-scale educational campaigns were limited, the company has focused on empowering South Africans with knowledge about savings, investments, and insurance through targeted programs. By positioning itself as more than just a service provider but also an educator, Liberty strengthened customer trust and loyalty.

Lessons for Aspiring Entrepreneurs

Liberty Group’s journey offers valuable insights for entrepreneurs:

- Identify Market Gaps: Donald Gordon’s success stemmed from recognizing an underserved market segment and creating tailored solutions.

- Adapt to Change: Economic shifts and industry disruptions are inevitable; resilience and diversification can safeguard long-term success.

- Leverage Strategic Partnerships: Collaborating with larger institutions, like Standard Bank, helped Liberty scale faster.

- Invest in Innovation: Staying ahead of trends, especially in fintech and digital services, ensures continued relevance.

- Educate and Empower Customers: Building trust through financial literacy initiatives fosters long-term customer relationships.

Conclusion: A Legacy of Growth and Stability

From its humble beginnings in 1957 to becoming a dominant player in South Africa’s financial sector, Liberty Group’s rise is a testament to visionary leadership, strategic decision-making, and an unwavering commitment to customer needs. Today, the company stands as a beacon of resilience and innovation, offering a blueprint for businesses aiming to create lasting impact in their industries.

For aspiring entrepreneurs, Liberty’s story is more than just an inspiring tale—it’s a masterclass in building a brand that withstands time, challenges, and market changes.