Naspers: From Local Publisher to South African Tech Monopoly

Naspers: From Local Publisher to South African Tech Monopoly. Naspers, one of South Africa’s most powerful and influential companies, has grown from a local newspaper publisher into a global technology and media giant. Through strategic investments, innovative expansion, and resilience in adapting to market changes, Naspers has positioned itself as a dominant player in various industries, from media to e-commerce and fintech. This article explores the key milestones, challenges, and strategic decisions that contributed to Naspers’ rise, offering insights for entrepreneurs looking to build successful, enduring enterprises.

The Early Years: A Publishing Powerhouse

Founded in 1915 as a newspaper publisher in Stellenbosch, Naspers initially focused on Afrikaans-language media. Over the decades, it became a dominant force in South African print and television, owning influential newspapers and launching M-Net, South Africa’s first pay-TV broadcaster. This stronghold in media laid the foundation for the company’s future ventures.

Lesson: Build a Strong Core Business

A solid foundation in a core industry allows businesses to generate revenue and establish brand recognition before expanding into new markets.

The Tencent Investment: A Defining Moment

One of the most significant turning points in Naspers’ history came in 2001 when the company invested $32 million in a then-little-known Chinese tech startup, Tencent. This investment, which led to Naspers owning a substantial stake in Tencent, proved to be one of the most successful tech bets of all time. As Tencent grew into a global internet giant, Naspers’ stake skyrocketed in value, providing the company with massive capital to reinvest in other businesses.

Lesson: Strategic Investments Can Transform a Business

Identifying high-growth potential in emerging markets and investing early can lead to exponential returns.

Expansion into Digital and E-Commerce

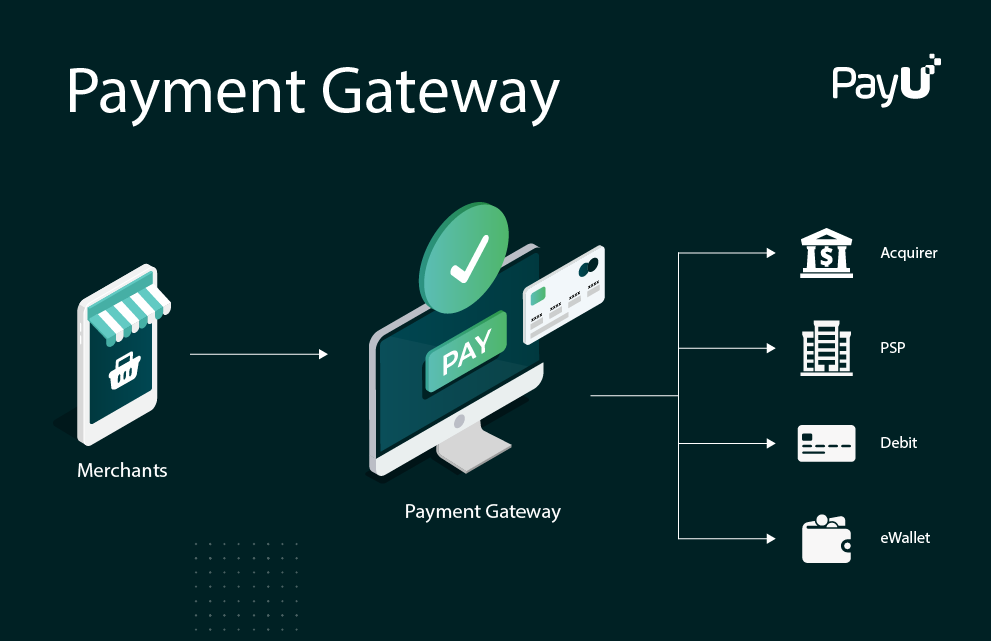

With capital from its Tencent windfall, Naspers aggressively expanded into digital services, e-commerce, and fintech across emerging markets. The company acquired stakes in businesses like OLX (classifieds), Takealot (e-commerce), and PayU (fintech). These acquisitions positioned Naspers as a dominant player in digital commerce across Africa, Latin America, and parts of Europe.

Lesson: Diversification Fuels Growth

Expanding into adjacent industries reduces reliance on a single revenue stream and creates new growth opportunities.

The Monopoly Debate: Dominance in South Africa

Naspers’ influence in South Africa has led to debates about its monopolistic presence in various sectors. Through its control of MultiChoice (DStv), Takealot, and its extensive digital portfolio, Naspers dominates the country’s media and online retail landscape. This market control has raised concerns about competition and innovation within the country.

Lesson: Balancing Market Power with Fair Competition

Businesses that achieve dominance must balance growth with ethical considerations, ensuring that innovation and competition thrive in their industries.

Structural Changes: Creating Prosus

In 2019, Naspers spun off its international internet assets into a new entity, Prosus, which is listed on the Amsterdam Stock Exchange. This move was aimed at reducing Naspers’ dominance in the Johannesburg Stock Exchange (JSE), where its Tencent stake had made up an outsized portion of the index. Prosus now serves as Naspers’ global investment vehicle, managing its stakes in tech companies worldwide.

Lesson: Corporate Restructuring Can Unlock Value

For businesses with diverse assets, restructuring can help optimize financial performance and shareholder value.

Future Challenges and Opportunities

Despite its success, Naspers faces challenges in balancing its South African operations with its global expansion. Regulatory scrutiny, increased competition in digital markets, and the need for continued innovation will shape the company’s next phase of growth.

Conclusion: Lessons from Naspers’ Success

Naspers’ journey from a local media company to a global tech powerhouse illustrates the power of strategic investments, adaptability, and diversification. Entrepreneurs can learn from its ability to recognize market trends early, take calculated risks, and expand across industries and geographies. However, the challenges of maintaining fair competition and navigating regulatory landscapes serve as important reminders for businesses aiming for long-term success.