How Dotsure.co.za Became a Digital Disruptor in South Africa’s Insurance Industry

How Dotsure.co.za Became a Digital Disruptor in South Africa’s Insurance Industry. When Dotsure.co.za entered South Africa’s insurance space in 2011, it was entering a crowded market dominated by legacy players with deep pockets and decades of brand equity. But instead of mimicking the traditional model, Dotsure.co.za chose a different path—one built on digital-first innovation, customer-centricity, and daring to challenge the status quo. Over the years, this approach would transform the brand into one of South Africa’s most popular and fastest-growing insurers.

Laying the Foundation: Digital DNA from Day One

Founded in George, Western Cape, Dotsure.co.za is part of the Oakhurst Insurance Company Ltd. From the outset, the brand focused on leveraging technology to simplify insurance. Its early product lineup centered on comprehensive pet insurance—a relatively underdeveloped niche in South Africa at the time.

While traditional insurers relied heavily on brokers, paperwork, and call centers, Dotsure.co.za went digital. They introduced an intuitive online platform that allowed users to quote, compare, and buy insurance in minutes. This gave them a crucial edge, especially among tech-savvy consumers looking for convenience and speed.

Strategic Differentiation: Niche Focus and Product Flexibility

Rather than spreading itself thin across multiple insurance categories from the beginning, Dotsure.co.za zoned in on underserved markets like pet insurance and later, car insurance. Their ability to let customers customise their car insurance cover was a standout move. Users could choose to remove cover options they didn’t need, helping reduce premiums.

This modular approach, rarely seen in traditional insurers at the time, resonated with a generation of consumers who demanded transparency and control. It wasn’t just about selling policies—it was about putting the power back into the customer’s hands.

Key Milestone: Direct-to-Consumer Model and Online Claims

One of the most pivotal moves came when Dotsure.co.za went all-in on a direct-to-consumer (D2C) model. This allowed the brand to maintain tighter control over the customer experience while reducing costs typically associated with intermediaries.

Moreover, they rolled out a fully digital claims process. Customers could submit claims online with supporting documents and track progress in real time. This eliminated much of the friction and frustration that plagued traditional claims processes, earning Dotsure.co.za high customer satisfaction scores.

Marketing with Authenticity: Humor, Relatability, and Pet-Lovers

Dotsure.co.za didn’t rely on fear-based or overly formal advertising. Instead, they leaned into humor and relatability. Their pet insurance campaigns were quirky and memorable, striking a chord with animal lovers across the country. The messaging was clear: “We understand your world, and we’ve built our products for it.”

This tone helped humanize a typically dry industry and fostered trust. The brand’s social media presence further amplified this approach, turning engagement into loyalty. Customer reviews and word-of-mouth quickly became organic growth channels.

Overcoming Challenges: Building Trust in a Skeptical Market

Selling insurance online isn’t easy in a country where skepticism about digital transactions remains relatively high, especially in the early 2010s. To overcome this, Dotsure.co.za invested in transparent communication, easy-to-understand policies, and 24/7 customer support.

They also embraced third-party platforms like Hellopeter to publicly resolve complaints, turning potential detractors into advocates. The company’s responsiveness and openness to feedback gradually cemented its reputation as a trustworthy player.

Innovation and Expansion: From Niche to Mainstream

As confidence in the brand grew, Dotsure.co.za expanded into more mainstream offerings like vehicle and personal insurance. But their DNA of flexibility and tech-led service remained.

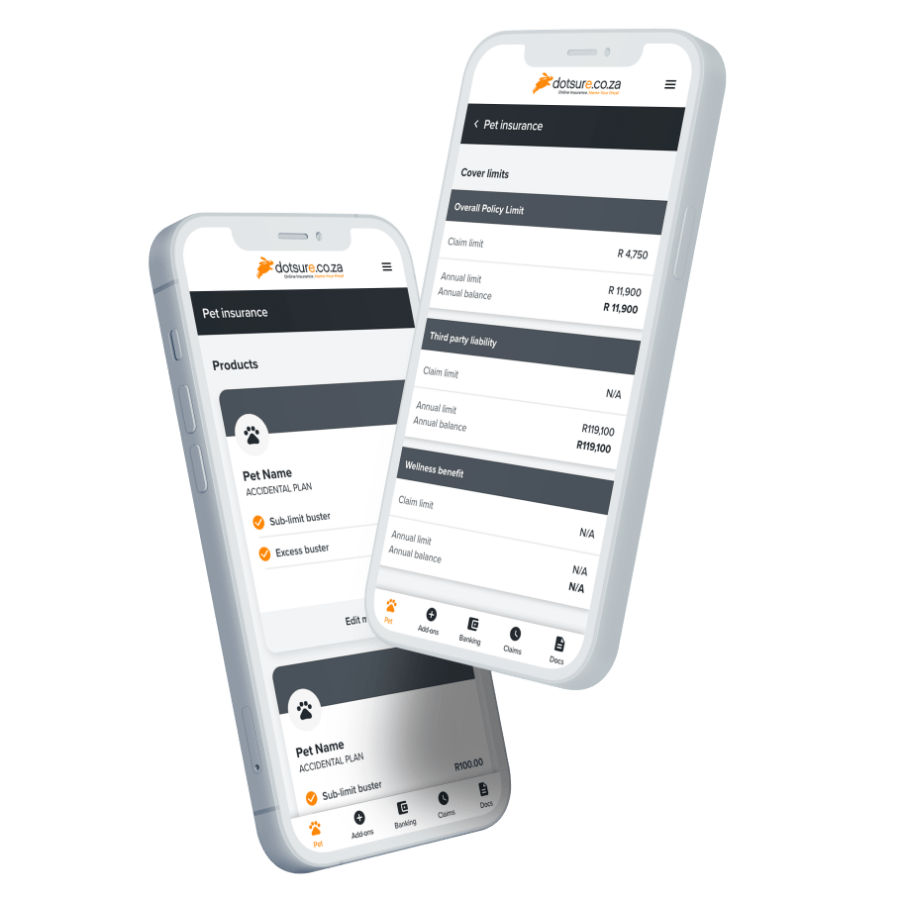

In 2019, they launched app-based services to streamline customer interactions even further. This included policy management, real-time chat support, and push notifications for claims status updates. Every move reinforced their commitment to making insurance as painless as possible.

Actionable Lessons for Entrepreneurs

- Start with a sharp focus: Dotsure.co.za didn’t try to be everything to everyone. They picked a niche and dominated it.

- Challenge traditional models: By going digital-first and D2C, they cut out inefficiencies and improved customer experience.

- Let the customer lead: From modular products to transparent claims, the customer’s needs shaped the offering.

- Authenticity wins: Marketing that speaks human-to-human builds long-term trust.

- Resilience is built in the trenches: Facing skepticism head-on and doubling down on service quality helped the brand weather early doubts.

Final Thoughts

Dotsure.co.za’s journey from a small player in George to a national digital disruptor proves that the insurance industry—often seen as rigid and slow-moving—can be reinvented. For entrepreneurs, it offers a blueprint on how to enter a mature industry and win by focusing on authenticity, agility, and putting the customer at the center of every decision.