African Financial Services StartUp TeamApt Inc. Rebrands To Moniepoint Inc.

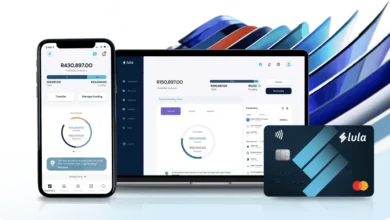

African Financial Services StartUp TeamApt Inc. Rebrands To Moniepoint Inc. Nigerian financial services startup TeamApt Inc has announced that it has rebranded to Moniepoint Inc. The company seeks to empower business dreams through payment solutions, access to loans, business management tools and insurance.

Founder and CEO Tosin Eniolorunda said in a post on LinkedIn, “I’m proud to announce that today, TeamApt Inc. takes on the name of our flagship product to become known as Moniepoint Inc. When Felix and I co-founded TeamApt in 2015, our efforts were channelled towards creating infrastructure and payment solutions that would change how financial transactions are carried out in Africa.”

Moniepoint is a global business payments and banking platform and recently became QED Investors’ first investment in Africa. It is the partner of choice for over 600,000 businesses of all sizes, powering the dreams of SMBs and providing them with equal access to the tools they need to grow and scale.

“Some years later, in 2019, we transitioned into a more direct approach, motivated by businesses out there which form a crucial part of our everyday lives. We’ve spent the last 3 years committed to providing businesses with all they need to grow, and that has led us to a lot of solid accomplishments, each validating the work we put in every day.For me and everyone at Moniepoint Inc. (Formerly TeamApt Inc.), this name change deepens our commitment and strengthens our drive to power the dreams of businesses, and we’re excited to have you along as we do more.” Eniolorunda concluded.

The company is Nigeria’s largest business payments platform, recognised by the Central Bank of Nigeria as the most inclusive payment platform in the country, and it processes $170 billion in annual run-rate transaction value. It is a fully remote tech company with a diverse workforce all over the world. Headquartered in London with offices in the US, Nairobi and Lagos.