These Are The Top 10 Most Influential Companies In The World

Time Magazine has released its list of the Top 100 Influential Companies in the world. The definition of influential is someone or something that has an impact on or shapes how people act or how things occur. A person who convinces others to listen and do what he suggests is an example of an influential person. According to Time Magazine, these are the most influential companies in the world. The companies have had significant impact in people’s lives throughout the world. Below are the top 10 influential companies obtained from Time Magazine.

Hello Sunshine

Hello Sunshine is an American media company founded by actress Reese Witherspoon and Strand Equity Founder and Managing Partner Seth Rodsky in 2016. Pacific Standard, the production company Witherspoon co-founded with Bruna Papandrea in 2012, now serves as a subsidiary for Hello Sunshine. On July 10, 2018, its co-owner AT&T through its communications division announced the launch of a Hello Sunshine branded cable and satellite television channel Hello Sunshine Channel focused on women similar to Oprah Winfrey Network.

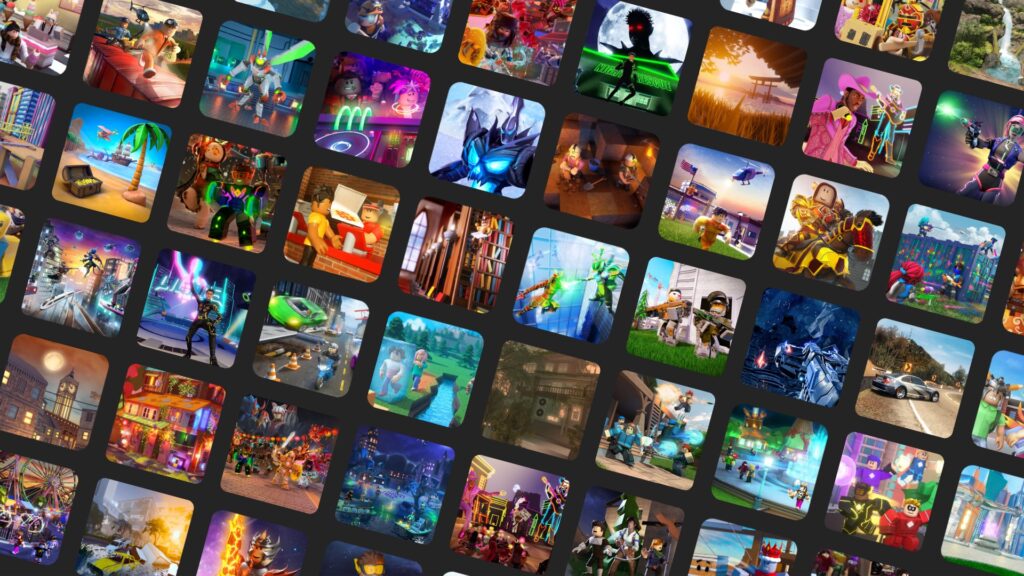

Roblox

Roblox is an online game platform and game creation system developed by Roblox Corporation. It allows users to program games and play games created by other users. Founded by David Baszucki and Erik Cassel in 2004 and released in 2006, the platform hosts user-created games of multiple genres coded in the programming language Lua. For most of Roblox’s history, it was relatively small, both as a platform and a company, due to both co-founder Baszucki’s lack of interest in press coverage and it being “lost among the crowd” in a large number of platforms released around the same time. Roblox began to grow rapidly in the second half of the 2010s, and this growth has been accentuated by the COVID-19 pandemic.

The National Basketball Association (NBA)

The National Basketball Association (NBA) is a professional basketball league in North America. The league is composed of 30 teams (29 in the United States and 1 in Canada) and is one of the four major professional sports leagues in the United States and Canada. It is the premier men’s professional basketball league in the world. The league was founded in New York City on June 6, 1946, as the Basketball Association of America (BAA). It changed its name to the National Basketball Association on August 3, 1949, after merging with the competing National Basketball League (NBL). The NBA’s regular season runs from October to April, with each team playing 82 games. The league’s playoff tournament extends into June. As of 2020, NBA players are the world’s best paid athletes by average annual salary per player.

Apple Inc.

Apple Inc. is an American multinational technology company headquartered in Cupertino, California, that designs, develops, and sells consumer electronics, computer software, and online services. It is considered one of the Big Five companies in the U.S. information technology industry, along with Amazon, Google, Microsoft, and Facebook. Its hardware products include iPhone smart phones, iPad tablet computers, Mac personal computers, iPod portable media players, Apple Watch smart watches, Apple TV digital media players, AirPods wireless earbuds, AirPods Max headphones, and the HomePod smart speaker line. Apple’s software includes the iOS, iPadOS, macOS, watchOS, and tvOS operating systems, the iTunes media player, the Safari web browser, the Shazam music identifier, and the iLife and iWork creativity. Apple was founded by Steve Jobs, Steve Wozniak, and Ronald Wayne in April 1976 to develop and sell Wozniak’s Apple I personal computer, though Wayne sold his share back to Jobs and Wozniak within 12 days. It was incorporated as Apple Computer, Inc., in January 1977, and sales of its computers, including the Apple II, grew quickly.

Gro Intelligence

Gro Intelligence has developed the world’s most extensive agriculture data platform. Gain a competitive edge through access to Gro’s unparalleled data, analytics, and forecasts from a single platform. Gro’s leading edge software automatically harvests disparate data, transforms it into knowledge, and uses machine learning to make predictions. Today, Gro offers: – The world’s most extensive collection of agriculture data – Analytical tools, predictive analytics, and proprietary models – Intuitive agriculture-centric visualisations and live dashboards.

Moderna Inc

Moderna Inc is an American pharmaceutical and biotechnology company based in Cambridge, Massachusetts. It focuses on drug discovery, drug development, and vaccine technologies based on messenger RNA (mRNA). Moderna’s technology platform inserts synthetic nucleoside-modified mRNA (modRNA) into human cells using a coating of lipid nanoparticles. This mRNA then reprograms the cells to prompt immune responses. It is a novel technique, abandoned by other manufacturers due to concerns about the toxicity of lipid nanoparticles at high or frequent doses

General Motors

General Motors Company (GM) is an American multinational corporation headquartered in Detroit, Michigan, USA that designs, manufactures, markets, and distributes vehicles and vehicle parts, and sells financial services, with global headquarters in Detroit’s Renaissance Centre. It was founded by William C. Durant on September 16, 1908, as a holding company, and the present entity was established in 2009 after its restructuring. The company is the largest American automobile manufacturer and one of the world’s largest automobile manufacturers.

Alibaba Group Holding Limited

Alibaba Group Holding Limited, also known as Alibaba Group and Alibaba.com, is a Chinese multinational technology company specializing in e-commerce, retail, Internet, and technology. Founded on 28 June 1999 in Hangzhou, Zhejiang, the company provides consumer-to-consumer (C2C), business-to-consumer (B2C), and business-to-business (B2B) sales services via web portals, as well as electronic payment services, shopping search engines and cloud computing services. It owns and operates a diverse portfolio of companies around the world in numerous business sectors.

Illumina Inc.

Illumina, Inc. is an American company. Incorporated in April 1998, Illumina develops, manufactures, and markets integrated systems for the analysis of genetic variation and biological function. The company provides a line of products and services that serves the sequencing, genotyping and gene expression, and proteomics markets. Its headquarters are located in San Diego, California. Illumina’s technology had purportedly by 2014 reduced the cost of sequencing a human genome to US$1,000, down from a price of $1 million in 2007. Customers include genomic research centres, pharmaceutical companies, academic institutions, clinical research organizations, and biotechnology companies.

Huawei Technologies Co., Ltd

Huawei Technologies Co., Ltd. is a Chinese multinational technology company headquartered in Shenzhen, Guangdong. It designs, develops, and sells telecommunications equipment and consumer electronics. The company was founded in 1987 by Ren Zhengfei, a former Deputy Regimental Chief in the People’s Liberation Army. Initially focused on manufacturing phone switches, Huawei has expanded its business to include building telecommunications networks, providing operational and consulting services and equipment to enterprises inside and outside of China, and manufacturing communications devices for the consumer market. Huawei has over 194,000 employees as of December 2019.