The Rise of Fintech in South Africa and What It Means for Startups

South Africa’s fintech sector has experienced rapid growth in recent years, fueled by advancements in technology, changing consumer preferences, and a supportive regulatory environment. Fintech, or financial technology, refers to innovative solutions that leverage technology to deliver financial services more efficiently, affordably, and inclusively. As fintech continues to gain momentum in South Africa, it presents significant opportunities for startups to disrupt traditional financial services, drive innovation, and address the evolving needs of consumers and businesses. In this article, we’ll explore the rise of fintech in South Africa and what it means for startups looking to enter the sector.

1. Fostering Financial Inclusion:

One of the primary drivers of fintech growth in South Africa is its potential to foster financial inclusion and empower underserved communities. Fintech solutions such as mobile banking, digital wallets, and peer-to-peer lending platforms are expanding access to financial services for millions of South Africans who were previously excluded from the formal banking sector. Startups that prioritize financial inclusion can tap into a vast market of unbanked and underbanked individuals, driving social impact while also capturing new revenue streams.

2. Disrupting Traditional Banking:

Fintech startups are challenging the dominance of traditional banks in South Africa by offering innovative alternatives that are more agile, customer-centric, and technologically advanced. Digital banks, robo-advisors, and payment platforms are reshaping the financial landscape, providing consumers and businesses with greater choice, flexibility, and convenience. Startups that can differentiate themselves through superior user experience, competitive pricing, and innovative features have the opportunity to capture market share and redefine the banking industry.

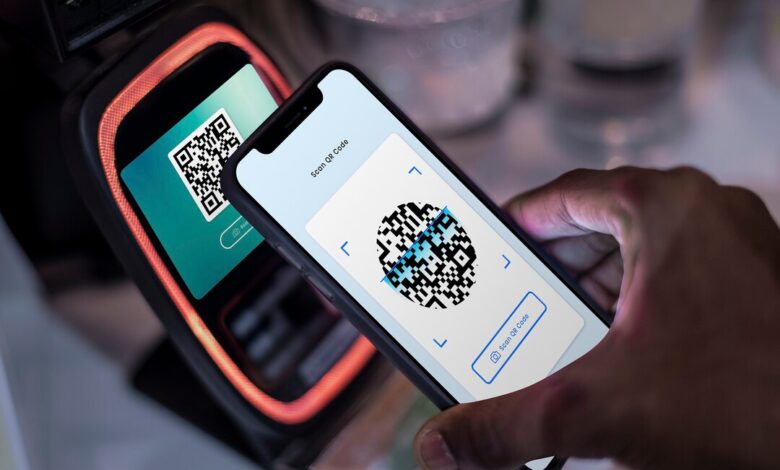

3. Driving Digital Payments Adoption:

The shift towards digital payments is accelerating in South Africa, driven by factors such as smartphone penetration, e-commerce growth, and the COVID-19 pandemic. Fintech startups are capitalizing on this trend by offering a variety of digital payment solutions, including mobile wallets, contactless payments, and blockchain-based transactions. Startups that innovate in the digital payments space can capitalize on the growing demand for secure, convenient, and efficient payment methods, capturing market share from traditional cash-based transactions.

4. Enabling Small Business Growth:

Fintech is playing a crucial role in supporting the growth and resilience of small and medium-sized enterprises (SMEs) in South Africa. Startups are offering a range of fintech solutions tailored to the needs of entrepreneurs, including online lending platforms, invoice financing, and digital accounting tools. By providing access to capital, streamlining financial processes, and facilitating e-commerce transactions, fintech startups are empowering SMEs to thrive in an increasingly digital economy.

5. Enhancing Financial Literacy and Education:

Fintech startups are not only providing financial products and services but also playing a vital role in enhancing financial literacy and education in South Africa. Through educational content, interactive tools, and personalized guidance, startups are helping consumers make informed financial decisions and improve their financial well-being. By prioritizing financial literacy and education, fintech startups can build trust, loyalty, and long-term relationships with their customers.

6. Navigating Regulatory Challenges:

While fintech presents significant opportunities for startups in South Africa, navigating the regulatory landscape can be challenging. Startups must ensure compliance with regulations governing financial services, data privacy, and consumer protection, which can vary across jurisdictions and evolve over time. Engaging with regulatory authorities, obtaining necessary licenses and permits, and implementing robust compliance frameworks are essential for startups to operate legally and sustainably in the fintech sector.

7. Collaborating with Established Institutions:

Collaboration between fintech startups and established financial institutions can accelerate innovation and drive mutual growth in South Africa’s fintech ecosystem. Partnerships and alliances can enable startups to access resources, expertise, and distribution channels while providing established institutions with access to innovative technologies and new customer segments. By fostering collaboration, startups and incumbents can create synergies that benefit the entire financial ecosystem.

8. Seizing Opportunities for Growth:

The rise of fintech in South Africa presents abundant opportunities for startups to innovate, disrupt, and thrive in a rapidly evolving industry. By addressing unmet needs, leveraging technology, and prioritizing customer experience, startups can differentiate themselves in the market and build sustainable businesses that drive positive change and create value for stakeholders. With strategic vision, agility, and a commitment to innovation, startups can play a pivotal role in shaping the future of finance in South Africa.

The rise of fintech in South Africa represents a transformative shift in the financial services landscape, driven by innovation, technology, and changing consumer behavior. For startups, the opportunities are abundant, from fostering financial inclusion and disrupting traditional banking to driving digital payments adoption and empowering small businesses. By understanding the market dynamics, navigating regulatory challenges, collaborating with established institutions, and seizing opportunities for growth, startups can position themselves for success in South Africa’s dynamic and rapidly evolving fintech ecosystem.