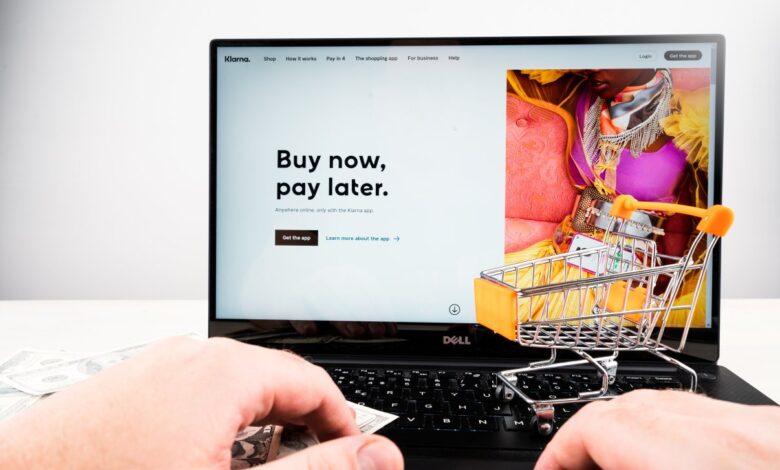

Things You Should Know About Buy Now Pay Later

Things You Should Know About Buy Now Pay Later. Buy Now, Pay Later (BNPL) is a financing option that allows consumers to purchase goods or services immediately and pay for them over time, often with little to no interest if payments are made on time. BNPL has gained popularity in recent years, particularly in e-commerce, due to its ease of use and consumer-friendly payment terms. Here are some key aspects of BNPL:

Payment Structure:

BNPL typically involves splitting the total purchase amount into several smaller, interest-free payments over a set period. For example, a purchase might be divided into four equal payments, with the first due at checkout and the remaining three spread out over the next six weeks.

Approval Process:

The approval process for BNPL is generally quick and easy, often requiring minimal credit checks. This makes it an attractive option for consumers who may not have access to traditional credit or prefer not to undergo a detailed credit assessment.

Interest and Fees:

BNPL programs usually offer interest-free periods, making them appealing to consumers. However, if a consumer misses a payment or fails to pay off the balance within the interest-free period, fees and interest charges may apply, potentially leading to higher costs.

Convenience:

BNPL offers consumers the convenience of spreading out payments without using a credit card or incurring immediate debt. This can help manage cash flow and reduce the financial burden of large purchases.

Retailer Benefits:

For retailers, offering BNPL options can increase sales, average order values, and customer loyalty. It provides an incentive for consumers to make purchases they might otherwise postpone or forego.

Risks for Consumers:

While BNPL can be a useful financial tool, it carries risks. Consumers may be tempted to overspend, leading to financial strain if they cannot meet the repayment terms. Additionally, missed payments can result in late fees and negatively impact credit scores.

Regulatory Environment:

As BNPL becomes more widespread, it is attracting regulatory scrutiny. Regulators in various jurisdictions are exploring measures to ensure transparency and consumer protection, such as clearer disclosure of terms and conditions and fair treatment of consumers.

Buy Now, Pay Later is an innovative financing option that offers flexibility and convenience to consumers and retailers. However, it requires responsible use and understanding of the terms to avoid potential pitfalls.