Interview with AfriNova Digital co-Founders Xolisa Vuza and Kagisho Dichabe, on their new Innovative App, digiToken

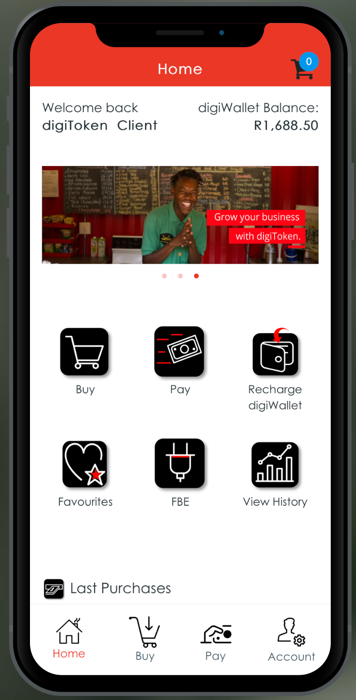

Interview with AfriNova Digital co-Founders Xolisa Vuza and Kagisho Dichabe, on their new Innovative App, digiToken! digiToken is a new convenient app that is set to help users with buying and paying their water, electricity, airtime and pay accounts like DSTV, home loans and Old Mutual in the comfort of their own homes.

The app’s timing could not be more perfect with the ongoing COVID-19 pandemic. Not only that it also takes on the unemployment issue by providing business opportunities. We recently had a chat with the founders of digiToken to talk about their start-up journey so far. Check it out below.

How did you guys get in the Digital Technology industry?

We both studied engineering and computer science degrees and worked for some of the largest companies in South Africa and abroad, advising them on business and technology architecture.

What sparked the idea for digiToken?

We both come from the township and rural areas and we’ve witnessed the struggles of our people in these areas to access the services we offer on the platform. We also wanted to create a platform that would extend these opportunities to people in the townships and rural areas to participate and make money for themselves.

How did you manage to get funding to get the business started?

digiToken has been self-funded through other business and personal savings for the initial launch. We are, however, in various discussions with potential investors who can work with us to grow digiToken

What would you say is the most innovative change that digiToken is bringing to the market place?

You don’t need to have a bank account to participate in digital economy on digiToken. All our clients don’t need internet banking to pay for their life insurance premiums or even their DSTv accounts. We are also addressing a very important challenge in Mzansi by creating much needed jobs. Any one can easily be a digiToken agent and earn commission for selling the services and products that are available on the digiToken platform. All they need is to register on digiToken and start transacting. We are, unfortunately, not able to divulge our roadmap openly before execution for competitive reasons. We are also working on some exciting features that will make our customers very happy and bring much needed convenience in their pockets.

How does the business generate profit to maximise productivity?

We are a completely automated business, which allows us to manage human resource costs. We also build and roll out features quite quickly through the use of modern platforms for software development. Our business is completely digital and we carry no costs of hardware and infrastructure as customers make use of cellphones. All of these factors allow us to manage our costs and maximise profit.

What are some of the difficulties the company has faced since the launch of digiToken?

Some of the challenges we’ve experienced are mainly around marketing and recruitment process, where we openly launch the platform and get to as many events as possible. COVID-19 has made it a bit challenging in terms of this part of the business.

Since the company also caters for the unbanked, what measures are in place to ensure that the money they have in the digiWallet is safe?

Our platform is hosted on the same cloud infrastructure that hosts most of the banking and defence systems in the world. The digiWallet is a virtual currency holder and can only be transacted upon, in the platform and nowhere else by the customer directly. We have never had any incident of someone’s wallet being breached for these reasons. To further illustrate this point, we see much higher attempts of fraud transactions on bank cards, instead of on digiWallets.

How did the company manage to partner with big brands such as DSTV and MTN?

Due to the experience we’ve gained and the roles we’ve played over the years, we are networked individuals because of our work and business backgrounds. The value proposition we made was also compelling and made sense to our partners, as the problem we aim to solve is a real one!

How has digiToken been received by the public since it launched?

We had a soft launch for the platform and are yet to have a hard launch. Having said that, we are satisfied with the uptake and the spread we believe comes from customer experiences who have used the platform.

What other plans does the company plan on implementing to provide further convenience for its customers?

On this one, we’d say keep it locked and don’t touch that dial. We have more exciting features that we are launching soon, and for the benefit of our clients. We will be sharing the latest updates across our social networks as well as websites on new features and partnerships as we close them.

What do customers need to have in order for them to use the app effectively without having difficulties?

All you need is to download the app in the Android and iOS stores. DigiToken is light on data usage and simple to install. Once registered, you will have access to more than 250 services and products that are offered on the platform, such as buying prepaid products and paying for various accounts like DSTv, Nedbank Loan and Old Mutual insurance premiums.

Where do you see the company in the next coming 5 years?

We see ourselves as the defacto app for buying of various services and products, and payments of various accounts that are linked to most aspects of the customer. We also see ourselves doing business in a few African countries as well. We will update the market as we progress.

For more information, and contact details:

Company name: digiToken

Phone number: + 27 (0)11 065 9559

Email: [email protected]

Website: https://digitoken.africa/

Twitter: @digi_Token

Facebook: @digiTokenSA

Instagram: @digiToken

digiToken is available on respective app stores for both Android and iOS devices. Search for digiToken on the app stores…