5 Small Businesses To Start In South Africa

5 Small Businesses To Start In South Africa. Starting a small business in South Africa offers numerous opportunities across various sectors, particularly in industries that are currently experiencing growth or addressing specific market needs. Here are five promising small business ideas to consider:

E-Commerce and Online Retail

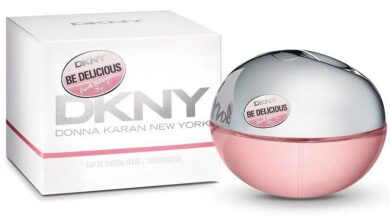

With the growing popularity of online shopping in South Africa, starting an e-commerce business can be highly profitable. You can sell a wide range of products, from fashion and beauty items to electronics and handmade crafts, catering to niche markets or general consumers.

Opportunities:

- Niche Markets: Focus on a specific niche, such as eco-friendly products, African-inspired clothing, or local artisanal goods, to differentiate your business.

- Dropshipping: Start with a low investment by partnering with suppliers who handle inventory and shipping, allowing you to focus on marketing and sales.

- Marketplaces: Utilize platforms like Takealot or Shopify to reach a broader audience without needing to build your own website from scratch.

Health and Wellness Services

The health and wellness industry is experiencing rapid growth as more people prioritize their physical and mental well-being. Starting a business in this sector can range from offering fitness coaching to wellness retreats or selling health-related products.

Opportunities:

- Fitness Studios: Open a boutique gym or yoga studio catering to a specific demographic, such as women, seniors, or high-intensity training enthusiasts.

- Wellness Products: Sell organic skincare products, nutritional supplements, or eco-friendly home goods online or in a physical store.

- Mental Health Services: Offer counseling, therapy, or life coaching services, either in-person or online, to address the increasing demand for mental health support.

Agribusiness and Organic Farming

Agriculture remains a vital sector in South Africa, with increasing interest in sustainable and organic farming practices. Starting a small agribusiness can include organic farming, poultry farming, or agritourism ventures.

Opportunities:

- Organic Produce: Grow and sell organic fruits, vegetables, or herbs to local markets, restaurants, or directly to consumers through farm-to-table services.

- Value-Added Products: Process and sell products like jams, sauces, or dried fruits that cater to health-conscious consumers.

- Agritourism: Create a farm experience that includes tours, educational workshops, or farm stays, attracting tourists and local visitors interested in sustainable farming.

Renewable Energy Solutions

As South Africa faces ongoing energy challenges, there is a growing demand for renewable energy solutions. Starting a business in this sector can involve providing solar power installations, energy efficiency consulting, or selling renewable energy products.

Opportunities:

- Solar Panel Installation: Offer solar energy solutions to residential, commercial, and industrial clients, helping them reduce reliance on the national grid.

- Energy Audits and Consulting: Provide services that help businesses and homeowners assess their energy consumption and identify ways to reduce costs and increase efficiency.

- Eco-Friendly Products: Sell products like solar-powered appliances, energy-efficient lighting, or backup power systems to consumers looking to reduce their carbon footprint.

Digital Marketing and Content Creation

With more businesses moving online, there is a high demand for digital marketing services to help them stand out in a crowded digital landscape. Starting a digital marketing or content creation business can involve services like social media management, SEO, or video production.

Opportunities:

- Social Media Management: Help small businesses build and manage their social media presence, creating content that engages customers and drives sales.

- SEO and Content Marketing: Offer search engine optimization and content creation services to improve website visibility and attract organic traffic.

- Video Production: Create promotional videos, tutorials, or branded content for businesses looking to enhance their online presence through video marketing.